Section 179 calculator

When you acquire equipment for your. The Section 179 Deduction has a real impact on your equipment costs.

Write Off Your Entire Purchase In 2021 With Section 179 Deduction Advancedtek

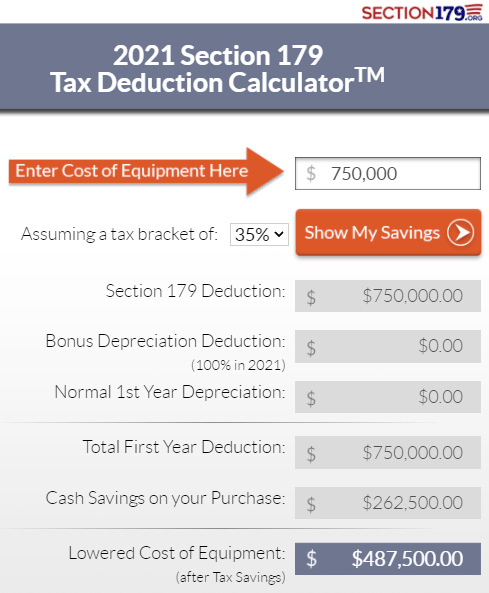

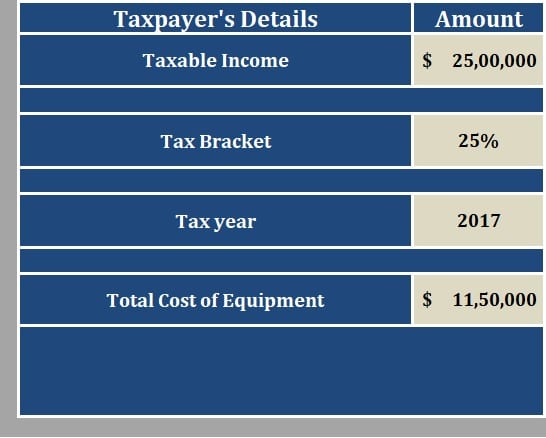

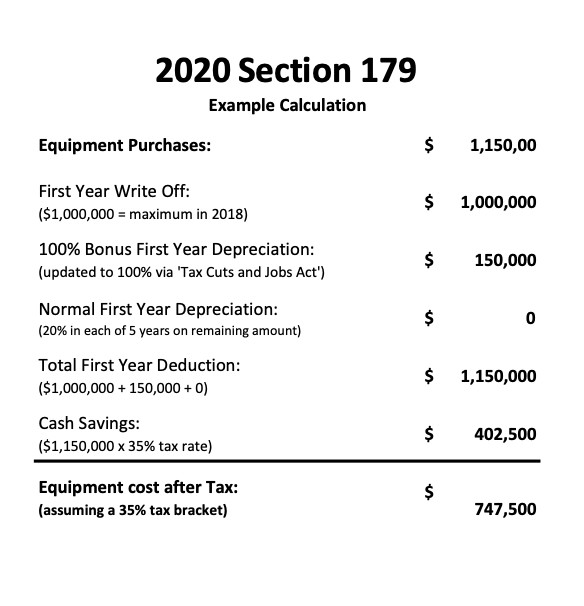

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can.

. There is also a limit to the total amount of the equipment purchased in one year ie. Heres How Section 179 works. Heres an easy to use calculator that will help you estimate your tax savings.

The total amount that can be written off in Year 2020 can not be more than 1040000. Use Our Section 179 Deduction Calculator To Find Out. To see how Section 179 savings can work for 2022 enter the amount you might spend on software or equipment and see the cash you might save.

Example Calculation Using the Section 179 Calculator. Section 179 Deduction Savings Calculator. This easy to use calculator can help you.

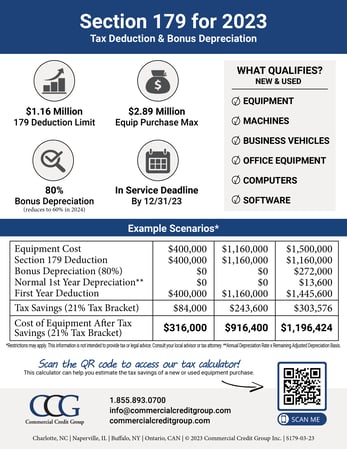

This means your company can deduct the full cost of qualifying equipment new or used up to. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. Section 179 Deduction Limits for 2021.

Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Companies can deduct the full price of qualified equipment purchases up to.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used. 1000000 in 2019 The Section 179 deductions decrease dollar for dollar on purchases over 25 million. You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179.

Section 179 allows your business to write off the entire purchase price of equipment for the current tax year. The Section 179 deduction limit for 2022 has been raised to 1080000. The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is leased or financed.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Simply enter in the. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. This has made a big difference for many. Under the Section 179 tax deduction you are able to deduct a maximum of.

Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Section 179 calculator for 2022 Enter an equipment cost to see how much.

The Section 179 deduction limit for 2021 is 1050000. There are some limits however to the amount that can be written off. Section 179 can save your business money because it allows you to take up to a 1080000 deduction when purchasing or leasing new machinery.

Bellamy Strickland Commercial Truck Section 179 Deduction

Tax Write Offs For Semi Truck Drivers Star Trailer Sales Semi Trailer News

Scientific Calculator With Graphic Functions Multiple Modes With Intuitive Interface Perfect For Beginner And Advanced Courses High School Or College Offi Scientific Calculator Ap Calculus Algebra Ii

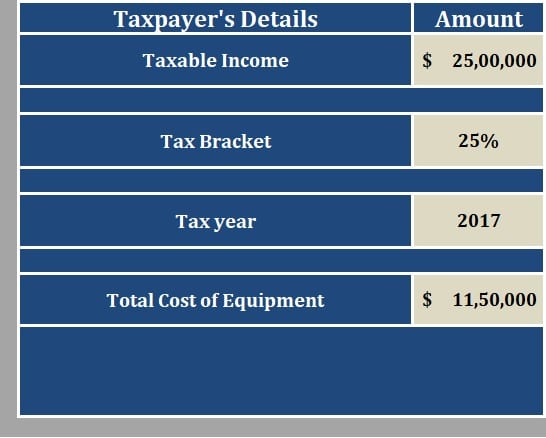

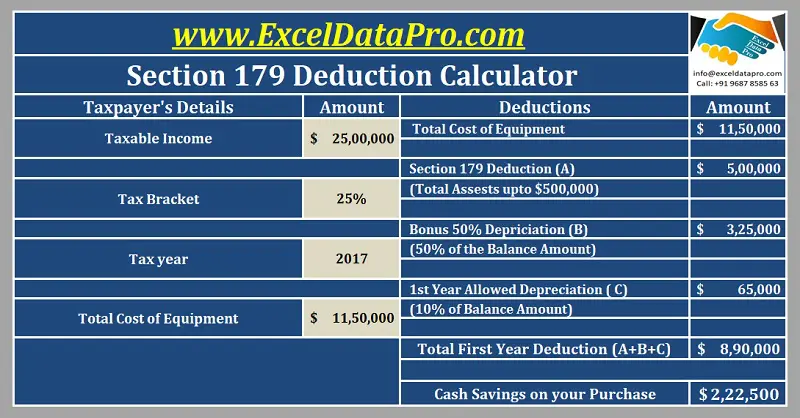

Download Section 179 Deduction Calculator Excel Template Exceldatapro

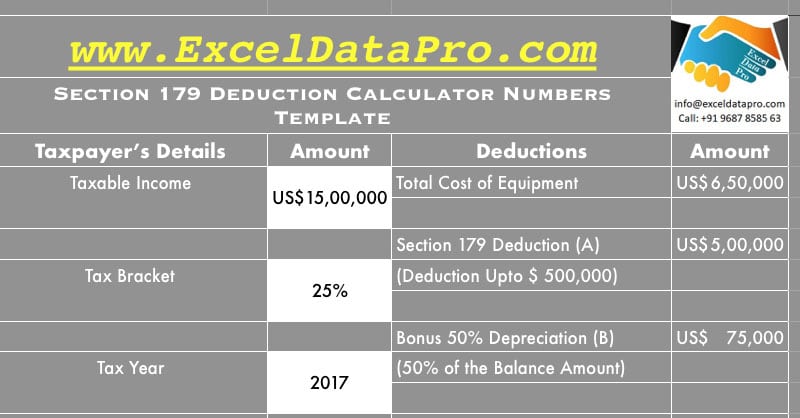

Download Section 179 Deduction Calculator Apple Numbers Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2022 Section 179 Tax Savings Your Business May Deduct 1 080 000 Youtube

Shopify Vs Etsy Fees Try Our Fee Calculator Aeolidia Etsy Business Craft Business Shopify Website

Section 179 Calculator Ccg

Save On A Multicam Cnc Machine With The Section 179 Tax Deduction

The Current State Of The Section 179 Tax Deduction

2018 Irs Section 179 Deduction News Update For Your Company

Write Off Your Entire Purchase In 2021 With Section 179 Deduction Advancedtek

Section 179 Calculator Ccg

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Casio Scientific Calculator With Natural Textbook Display In 2022 Scientific Calculator Calculator Casio

2020 Section 179 Commercial Vehicle Tax Deduction